Sum-of-years digits is a depreciation methodology that results in a extra accelerated write off of the asset than straight line however less than double-declining balance method. This method will scale back revenues and property more rapidly than the straight-line method but not as quickly because the double-declining methodology. The models-of-production methodology is calculated based on the models produced in the accounting interval. Depreciation expense will be decrease or greater and have a greater or lesser impact on revenues and property primarily based on the models produced in the period.

Boundless Accounting

Looking on the definition of Intangible asset we are able to verify that Cash is NOT an intangible asset as IASs has explicitly excluded it from its definition. Intangible advantages embrace all of the qualitative advantages of working for an organization. For instance, pleasant coworkers, flexibility and a position that matches the employee’s ability set are intangible benefits.

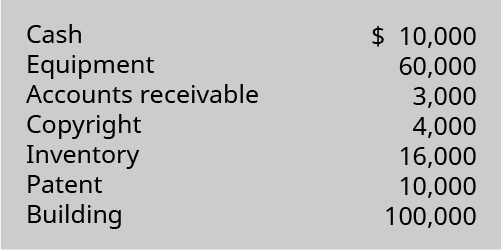

What are the three types of assets that will be found on a balance sheet?

Examples of intangible assets are copyrights, patents, and licenses. The accounting for an intangible asset is to record the asset as a long-term asset and amortize the asset over its useful life, along with regular impairment reviews. The accounting is essentially the same as for other types of fixed assets.

Goodwill (accounting)

Companies involved in producing goods have tangible property, together with the automobile and steel industries. The manufacturing facility gear, computers, and buildings would all be tangible belongings. Current property include gadgets similar to money, inventory, and marketable securities. These items are typically used within a 12 months and, thus, could be extra readily sold to raise money for emergencies.

What are the tangible benefits?

Examples of intangible assets include goodwill, brand recognition, copyrights, patents, trademarks, trade names, and customer lists. You can divide intangible assets into two categories: intellectual property and goodwill. Intellectual property is something that you create with your mind, such as a design.

However, employees are prone to drag their feet and usually be unproductive if compelled to work a day that they might somewhat have off. This would have been an opportunity for the corporate to increase the intangible benefit of boosting employee morale.

Human Capital vs. Physical Capital: What’s the Difference?

Amortization is the method of allocating an intangible asset’s value over the course of its useful life. Depreciation is the method of allocating a tangible asset’s value over the course of its helpful life. An asset’s helpful life is the length it adds worth to your business.

The better of circumstances is selecting a job that offers enticing tangible and intangible advantages. Below is a portion of the stability sheet for Exxon Mobil Corporation (XOM) as of December 31, 2019, as reported on the corporate’s annual 10-K filing. Technology firms which might be involved in producing smartphones, computers, and different digital units use tangible belongings to produce their items. There are numerous industries which have corporations with a excessive proportion of tangible belongings.

If you’ve got ever labored for a company that does not have their workers’ best pursuits at heart, then you’ve got a fairly good concept of what occurs. The employees begin to resent the managers, the managers resent the employees, clients are finally misplaced, and suddenly the enterprise collapses. Do you need a easy method to record all of your company’s belongings? Patriot’s primary accounting software program is made for small enterprise house owners and is completely cloud based.

The definition of intangible is one thing with no bodily presence that can’t be touched, or is one thing that’s vague and obscure or worth in concrete terms. It is essential to grasp the idea of goodwill as a result of it’s the metric which encapsulates the value of the reputation of an organization constructed over a big time frame.

What Is the Difference Between Tangible & Intangible Benefits?

For the double-declining steadiness technique, revenues and belongings shall be decreased more within the early years of an asset’s life, as a result of greater depreciation expense, and fewer within the later years. These 4 strategies of depreciation (straight line, units of production, sum-of-years-digits, and double-declining stability) impression revenues and belongings in several ways. A credit to Accumulated Depreciation (a contra-asset account that is reported in the same part of the steadiness sheet because the asset that’s being depreciated). The purpose of depreciation is to achieve the matching precept of accounting.

- An individual who owns stock in a company is known as a shareholder and is eligible to assert part of the corporate’s residual assets and earnings (should the corporate ever be dissolved).

- For example, there isn’t a price ticket on the worth of your company’s logo.

- In this lesson we took a take a look at the difficulties to find the value of an intangible profit, which is a more subjective profit that you could’t truly contact and is difficult to measure in dollar phrases.

- In order to calculate goodwill, the honest market worth of identifiable belongings and liabilities of the corporate acquired is deducted from the acquisition price.

- Intangible assets are non-physical assets which have a monetary value since they symbolize potential revenue.

- Under IFRS and US GAAP requirements, goodwill is considered as an intangible asset with an indefinite life, and as such, there isn’t a requirement to amortize the value.

Asset

Most of the companies favor to amortize goodwill over a interval of 10 years. Let us take the instance of firm ABC Ltd which has agreed to accumulate https://cryptolisting.org/blog/what-are-the-costs-for-free-on-board company XYZ Ltd. The purchase consideration is of $a hundred million in order to get hold of 95% stake in XYZ Ltd.

How is goodwill calculated?

Land – although a fixed asset – is never depreciable. It has an unlimited useful life and therefore cannot be “used up.” Improvements made to depreciable property are called betterments and can be depreciated. They should be capitalized and depreciated separately from the original depreciable property.

As per an esteemed valuation company, the truthful worth of the non-controlling curiosity is $12 million. It is also estimated that the truthful value of identifiable assets and liabilities to be acquired are $200 million and $90 million respectively. Double-declining steadiness is a sort of accelerated depreciation method. This method information larger amounts of depreciation through the early years of an asset’s life and lower amounts through the asset’s later years. Thus, within the early years, revenues and property shall be decreased more because of the greater depreciation expense.

But, the worth of your tangible belongings does not reflect your corporation’s complete value. Goodwill measures several elements that affect your model’s worth. Examples of goodwill include your company’s reputation, methods, buyer base, and worker relations. Current belongings, such as stock, are anticipated to be converted to money or used within a 12 months. But does it imply that if it is not an intangible asset then it is a tangible asset?

Usually, you can find the value of tangible property as a definite quantity bookkeeping. You add up the value of every tangible item for a complete value.

Aside from being used to generateincome, capital assets are essential for companies in that they are often bought if the business is in monetary problem or used ascollateralforbusiness loans. In this case the lender will usually problem alienagainst the asset so it may be seized if the mortgage isn’t repaid. However, corporations that fully ignore intangible benefits What is petty cash and its purpose? in their determination-making stand to lose huge. For example, let’s say that a company provides their staff a random time off in the course of the year. Although that is generous, they’d much quite have a day before or after a vacation off.

What are the three major types of intangible assets?

Tangible means something that can be understood. An example of tangible is a scientific fact that is not disputed. The definition of tangible is being touchable or real. An example of tangible is the Pyramid of Giza as an example of Egyptian history.

Johanna Schlegel, a human capital administration professional and writer for a distinguished job seekers’ web site, advises employees to assess how they feel in regards to the work they carried out on the end of the day. Measuring the diploma of dedication and agreement with corporate tradition are additional ways Schlegel recommends gauging the intangible benefits derived from the job. “Do what you love https://cryptolisting.org/,” typically is the mantra of individuals looking for jobs that provide intangible benefits, whereas companies that use golden handcuffs retain staff who need the tangible good thing about high salaries and nice benefits. When choosing where to work, people weigh tangible and intangible advantages.

Intangible property

There are numerous types of assets that might be thought of tangible or intangible, a few of that are short-term or lengthy-time period property. That which may be felt or touched; it must necessarily be corporeal, but it might be real or personal. The terni is utilized in contradistinction to property not tangible. In this class may be talked about copyrights and patent-rights. The popularity of a enterprise has worth but is an example of an intangible asset.

In some cases, a person may select work she despises performing however stays because of the excessive tangible advantages. Other times, people forego million-dollar monetary broker salaries to carry out low-paying humanitarian work they love doing.

That is, a company is attempting to match the historic cost of a productive asset (that has a helpful lifetime of greater than a year) to the revenues earned from utilizing the asset. While corporations will follow the foundations prescribed by the Accounting Standards Boards, there may be not a essentially right approach to take care of this mismatch beneath the current financial reporting framework. Therefore, the accounting for goodwill will be guidelines primarily based, and those guidelines have changed, and may be expected to proceed to alter, periodically along with the adjustments within the members of the Accounting Standards Boards. The current guidelines governing the accounting treatment of goodwill are highly subjective and may end up in very excessive prices, but have limited worth to investors.

Read on to be taught the variations between tangible belongings vs. intangible assets. Property that has bodily substance and may be touched; Anything apart from actual estate or cash, including furniture, vehicles, jewelry and china. Intangible property (instance; a verify account) lacks this bodily high quality. Under IFRS and US GAAP requirements, goodwill is taken into account as an intangible asset with an indefinite life, and as such, there isn’t any requirement to amortize the worth. However, it ought to be evaluated every year for impairment loss.

In later years, a lower depreciation expense can have a minimal impact on revenues and property. However, revenues may be impacted by higher prices associated to asset upkeep and repairs. Sum-of-years-digits depreciation is set https://en.wikipedia.org/wiki/Boilerplate_code by multiplying the asset’s depreciable value by a series of fractions primarily based on the sum of the asset’s useful life digits.

Either method, the fastened asset is written off the stability sheet as it is now not in use by the corporate. Even if IASs don’t define tangible asset, they have outlined one other sort of belongings referred to as financial asset. IAS 32 defines monetary asset in para eleven and if we look at the definition then Cash has been explicitly talked about in the definition.