Why Use Accruals?

The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet, and also as an expense in accrual accounting the income statement. On the general ledger, when the bill is paid, the accounts payable account is debited and the cash account is credited.

Combined, the income and cash flow statements present a full picture of when the company earns its money and when it gets its money. And significant discrepancies retained earnings between the two can raise red flags, such as revenue that has been recorded before it was earned — and before it was billed to the customer.

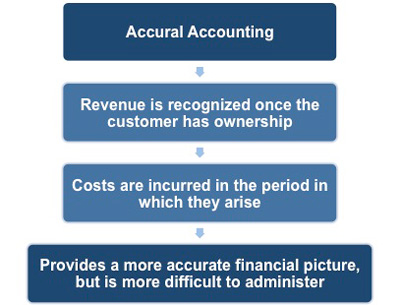

The cash method is a more immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses. Accrual basis accounting applies the matching principle – matching revenue with expenses in the time period in which the revenue was earned and the expenses actually occurred.

There are also modified versions of the cash method of accounting that allow for the limited use of accruals. Contracts with this language allow a general contractor to not pay the subcontractors if it hasn’t been paid by the owner. If a general contractor can write contracts in such a way, it could make an accounting method change that excludes normal balance the subcontractor payables from the numerator of the percentage completion formula. As mentioned above, reducing the contract costs from the numerator also reduces income from that contract for the year, which defers recognition of the contract profit to a future year. It should be noted that the contract has to include the pay if paid language.

It helps give a better picture of the company’s financial condition. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. Expenses of goods and services are recorded despite no cash being paid out yet for those expenses. For example, a company delivers a product to a customer who will pay for it 30 days later in the next fiscal year, which starts a week after the delivery.

It may raise capital for purchasing stock, the lifeblood of any store, by showing an accurate future from current sales. By not using the accrual accounting method the store’s bank balance may look bare and not very attractive to investors and bankers. Under the accrual method, transactions are counted when the order is made, the item is delivered, or the services occur, regardless of when the money for them (receivables) is actually received or paid.

Owners, investors, and creditors can learn a lot from your balance sheet and your income statement. The balance sheet tells what assets your company has now and where they came from.

Accruals And Debitoor

By requiring businesses to book revenue when earned and expenses when incurred, GAAP aims to prevent companies from misrepresenting their business activity by manipulating the timing of cash flows. Under cash accounting, a business could avoid recording a loss for, say, the month of June simply by holding off on paying its bills until July 1. If September looks like it’s going to be a weak month for sales, a company could prop up the numbers by delaying the billing of some customers so that their payment doesn’t arrive until after Sept. 1. With accrual accounting, a company hoping to manipulate its numbers like this would have to lie about the timing of revenue and expenses — in other words, to commit fraud. The above occurrence highlights the concept of accrual accounting, the accounting method used in the United States by publicly traded companies.

The general idea is that economic events are recognized by matching revenues to expenses (the matching principle) at the time in which the transaction occurs rather than when payment is made or received. This method allows the current cash inflows or outflows to be combined with future expected cash inflows or outflows to give a more accurate picture of a company’s current financial position. Accrual accounting is in contrast to cash accounting, which only considers money that has actually exchanged hands, rather than factoring in amounts of cash that a company expects to receive.

A company that uses the cash accounting method will record $5,000 revenue on Nov. 25. The use of accrual accounts greatly improves the quality of information on financial statements.

In contrast to the cash method, accrual basis accounting entails recording revenue once an invoice is made and recording expenses once you’re charged. This means that you make a record of income even before it reaches your bank account, and you note deductions for bill payments and the like before they’re paid. A business that uses the accrual basis of accounting recognizes revenue and expenses in the accounting period in which they are earned or incurred, regardless of when payment occurs. This differs from the cash basis of accounting, under which a business recognizes revenue and expenses only when cash is received or paid. Two concepts, or principles, that the accrual basis of accounting uses are the revenue recognition principle and the matching principle.

The income statement reports earned income on an accrual basis (recognizing revenues when earned and expenses as incurred regardless of when cash is received or paid). But the key to surviving in business is generating the cash you need to keep it up and running. It’s http://www.benchi008.com/chua-duoc-phan-loai/can-xero-be-used-offline.html not unusual to hear reports about companies with cash problems. Sometimes they arise because the products in which the firm has invested aren’t selling as well as it had forecast. Maybe the company tied up too much money in a plant that’s too big for its operations.

- During the year of change, the company will include all items of income that were actually or constructively received and deduct expenses that were actually paid.

- In general, companies with average annual gross receipts in the prior three years that are less than $10 million (less than $5 million for C corporations) can make an automatic method change to the cash method.

- Switching from the accrual basis to cash basis of accounting could create a substantial deferral of income and reduction of current-year tax.

However, the recording of transactions in cash accounting occurs at the time of cash transactions. Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs rather than when payment is received or made. It reflects a better association of revenues and expenses with the appropriate accounting period. The accrual basis of accounting recognizes all resource changes when they occur. The cash basis of accounting limits the recognition of resource changes to cash flows.

Accrual Basis Accounting

Suppose you are a firm M/S ABC Pvt Ltd, and you are using accrual accounting to maintain your books of accounts. Here, any revenue or income which is generated by sales and expenses incurred are recorded as they occur.

Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. If you want to see if a particular month was profitable, accrual will tell you.

What is an example of accrual accounting?

Accrual Accounting. Definition: Accounting method that records revenues and expenses when they are incurred, regardless of when cash is exchanged. The term “accrual” refers to any individual entry recording revenue or expense in the absence of a cash transaction.

Diagram Comparing Accrual And Cash Accounting

Though the store sold the stock purchased at the beginning of the month, the money is not yet fully in the bank and raising the fear of a cash flow problem. By using adjusting entries, all sales, both cash and credit, are included. To manage this, the store runs an ‘accounts receivable’ ledger, recording all transactions as revenue on the day of sale. The accrual accounting method makes the store’s revenue streams obvious from the time the buyer makes the purchase.

What is the difference between cash and accrual accounting?

For example, an account receivable. In other words, a company receives a mobile phone bill in January for a past period (December of the previous year), this would be recorded as an expense accrual. Revenue: when services or goods have been provided by the company, but payment has not yet been received.

They need to book accrual entries when a company has earned revenue but not yet received payment or it has incurred an expense but hasn’t yet paid the bill. The alternative to accruing transactions is maintaining the accounting records on a cash basis. The difference between cash basis and accrual basis accounting comes down to timing. If you do it when you pay or receive money, it’s cash basis accounting. If you do it when you get a bill or raise an invoice, it’s accrual basis accounting.

A user fee would apply to this nonautomatic change and will require filing Form 3115 with the IRS. Difficulty is one huge drawback of accrual basis accounting, where rules in the recognition of revenue and expenses can be very complicated.

The Effect On Cash Flow

Switching from the accrual basis to cash basis of accounting could create a substantial deferral of income and reduction of current-year tax. In general, companies with average annual gross receipts in the prior three years that are less than $10 million (less than $5 million for C corporations) can make an automatic method change to the cash method.